On 2 March, 2016, Shandong Longlive

Bio-technology Co., Ltd. (Longlive Bio-technology) announced on the Investor

Relation Management platform that it has put xylo oligosaccharide (XOS) into

the European feed market, and that it is partnering with an Italian pet food

giant for raw material supply.

At the same time, Longlive Bio-technology

pointed out that Herbalife International of America, Inc., one of its clients,

has imported Longlive Bio-technology's XOS and has successfully put the XOS

nutrients project into trial production, which helps Longlive Bio-technology to

lay a foundation for promoting XOS in overseas additives markets.

Longlive Bio-technology signed a supply

contract with Wm Wrigley Jr Company (Wrigley) in 2015, becoming the largest

xylitol supplier to Wrigley in Europe. This move also helped Longlive

Bio-technology to establish in the European food additive market.

Longlive Bio-technology has a promising

future in the feed industry. China's consumption of XOS used for feed additives

approached 1,600 tonnes in 2015, and is estimated to grow by 5% in the future.

XOS can effectively enhance the growth of intestine bacteria, and improve body

immunity.

Since 2003, the Ministry of Agriculture of

the People's Republic of China started to approve XOS to be used as a feed

additive in the livestock industry. As China further promotes feed without

antibiotics, substitutes for antibiotics will enjoy bright market prospects.

Longlive Bio-technology is China's largest

XOS producer, with a capacity of 4,000 t/a. Another production line for XOS

(6,000 t/a) is under construction. According to the original plan, this

production line should have been put into operation in Dec. 2015.

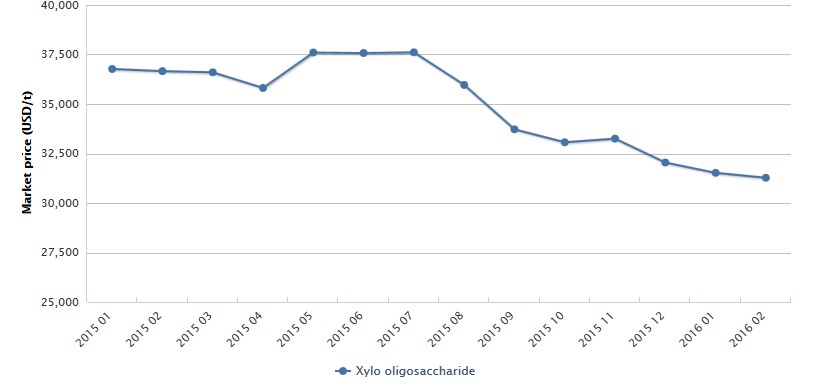

Market price of XOS in China, Jan. 2015-Feb.

2016

Source: CCM

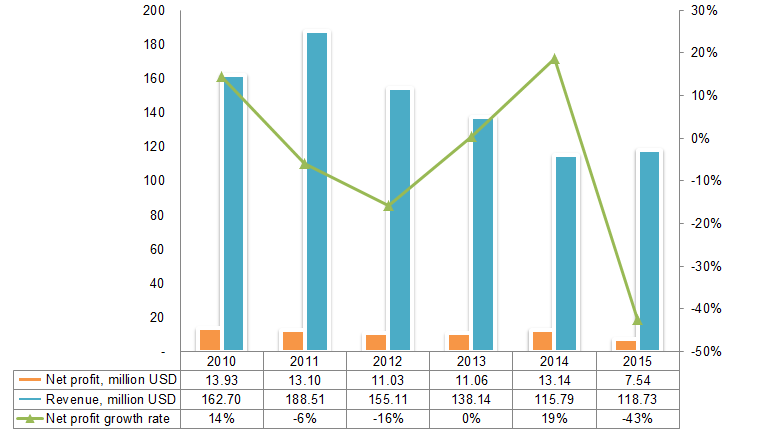

Longlive Bio-technology also released the

2015 performance briefing when it proclaimed to put XOS into the European

market. However, the performance was unsatisfactory.

Revenue: USD122.04 million (RMB776 million), up by 2.54% YoY

Operating profit: USD5.92 million (RMB37.65 million), down by 1.79% YoY

Total profits: USD10.08 million (RMB64.10 million), down by 38.5% YoY

Net profit: USD7.75 million (RMB49.29 million), down by 42.61% YoY

Fuel ethanol is the main reason for the

poor performance.

Longlive Bio-technolog's fuel ethanol which

is transported to China's oil system is priced at USD0.14 (RMB0.91) * the price

of No.93 gasoline. Affected by the international crude oil price slump, the

sales price and sales volume of fuel ethanol declined. Data from the New York

Mercantile Exchange shows that the price of Brent crude oil averaged

USD54.4/bbl in 2015, down by 47% YoY and hitting a record low of the past 10

years.

The Chinese government reduced the

subsidies on processing fuel ethanol from USD125.81/t (RMB800/t) in 2014 to

USD94.36/t (RMB600/t) in 2015.

As the Chinese government promotes the

policy on de-stocking of old corn, it is expected to increase the subsidies on

processing fuel ethanol, which is good for the development of Longlive

Bio-technology.

Longlive Bio-technology's financial

performance, 2010-2015

Source: Longlive Bio-technology

This article comes from Corn Products China News 1603, CCM

About CCM:

CCM is the leading market intelligence provider for China’s

agriculture, chemicals, food & ingredients and life science markets.

Founded in 2001, CCM offers a range of data and content solutions, from price

and trade data to industry newsletters and customized market research reports.

Our clients include Monsanto, DuPont, Shell, Bayer, and Syngenta. CCM is a

brand of Kcomber Inc.

For more information about CCM, please

visit www.cnchemicals.com or get in touch with us

directly by emailing econtact@cnchemicals.com or calling

+86-20-37616606.

Tag: XOS feed